How to Open Fixed Deposit in SBI Online

This post tells you how you can open a fixed deposit or FD account online in SBI using Internet banking. Basically you need to have Internet Banking enabled on your SBI savings account to open a fixed deposit online.

If you don’t have Internet Banking enabled, just go to your SBI branch and ask them for an ‘Online SBI Registration Form’. Fill the form and they will give an envelope containing your Username and Password.

The interest rate given on savings account in SBI is just 2.70% p.a. which can’t beat the rate of inflation. It means customer’s money is depreciating in a savings account.

In this case, FD can prove to be a better investment which gives interest in the range of 2.90% p.a. to 6.20% p.a. depending on the duration of the investment. The duration of FD can be 7 days to 10 years.

Recently I opened a fixed deposit or FD account online using Internet Banking. It’s a better way of escaping the crowd at the bank and wasting your time.

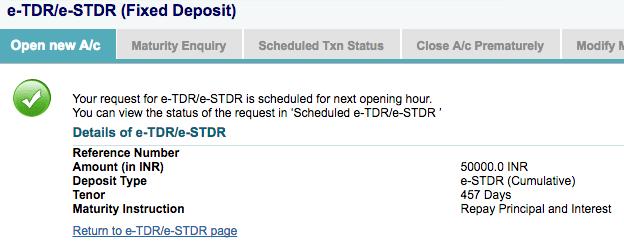

So I opened an FD of Rs.50000 and I am going to tell you the step-by-step procedure for opening an FD online.

These are the Steps to Open Fixed Deposit Account in SBI Online:

3) Now select a type of deposit account to proceed. For normal FD account, select the first type as shown in the image. Then click on Proceed.

4) Now enter the details of the Fixed Deposit Account as shown in the image.

a) Select the account from which you want to debit the amount for FD if you have more than one savings account or current account.

b) Then enter the amount of the fixed deposit. In my case, it was Rs. 50000.

c) Tick the senior citizen option if your age is 60 or above otherwise just ignore.

d) Now you have to select the term deposit options. There are 2 types of term deposits in SBI: STDR and TDR.

The full form of STDR is Special Term Deposit and full form of TDR is Term Deposit.

Now, most people get confused in STDR vs TDR.

If you want the interest for your FD paid at selected intervals, choose the TDR option.

If you want the interest for your FD paid at maturity, choose the STDR option.

e) Now you have to select the tenure or duration of the deposit. Select the duration which suits you. I chose 457 days for my FD.

f) Then you have to choose the maturity instruction for your FD.

There are 3 types of maturity instructions. Let me tell you with the help of my FD. I have deposited a principal amount of Rs.50000 at an interest rate of 7.50% for a period of 457 days. The interest on my FD will be Rs.4867.

1) If I select ‘Auto renew Principal and Interest’, then Rs.54867 will be deposited again for 457 days after the maturity date.

2) If I select ‘Auto renew Principal and repay Interest’, then Rs.4867 will be transferred to my savings account and Rs.50000 will be deposited again for 457 days after the maturity date.

5) Now you need to verify the FD details and click confirm.

6) Then you will get a confirmation message as shown in the image below.

Hope this article helps you in opening a fixed deposit account online using SBI Internet Banking!

Also Read:

Comments

Post a Comment